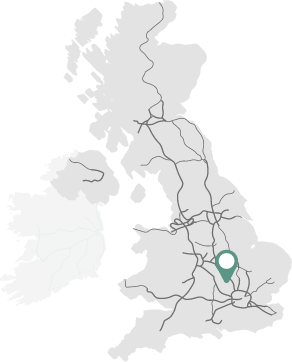

Multi-let industrial estate in Milton Keynes, one of the fastest growing cities in the UK and a major logistics hub.

Key statistics

Area (sq ft)

335,000

Contracted rent

£2.3m

WAULT

5.5 years

Occupiers

39

EPC A

48%

Why did we buy it?

Milton Keynes is a key area of focus for Warehouse REIT as its location within the Oxford-Cambridge Arc, and proximity to major arterial routes including the M1 make this an important logistics hub. It is also one of the fastest growing cities in the UK, providing access to an economically vibrant population and large, local labour force. Following the success of Granby Trade Park, acquired in 2020, we acquired Bradwell Abbey in 2022 where we have an exciting opportunity to revive the estate.

Bradwell Abbey is highly reversionary, with average rents of £7.83 per sq ft at acquisition compared to an estimated rental value of £9.89 per sq ft providing significant scope to drive rents on re-letting.

What have we done since purchase?

We have completed a full range of energy efficient initiatives, including LED lighting upgrades, installation of efficient mechanical ventilation and air conditioning, electrification of hot water and heat, air source heat pumps and fabric improvements, including improved insulation and door replacements. As a result, 48% of the site is now EPC A-C compared to 38% on acquisition. In addition, our refurbishment works will include public amenities such as a gym and coffee shop as well as improved access to the public realm and the introduction of native species to improve biodiversity.

Within c. 1 year, we had completed 4 lettings and 2 renewals at levels ahead of estimated rental value. Our focus will be on capturing the reversion through active asset management.