About us

What we do

We grow our portfolio by carefully choosing assets to acquire and by selectively developing new assets, often on under-utilised land within the portfolio. Our proactive asset management then unlocks the value inherent in the portfolio, helping us to capture rising rents and increase capital values. At the same time, we are increasingly embedding sustainability considerations into everything we do.

Business model

Inputs

Our portfolio

- Multi let warehouses

- Strategically located

- Attractive opportunities for development

People and relationships

- Experienced Board

- Dedicated Investment Advisor with extensive real estate expertise and strong industry relationships

Financial

- Sound financial position

- Access to a range of funding sources and significant headroom to covenants

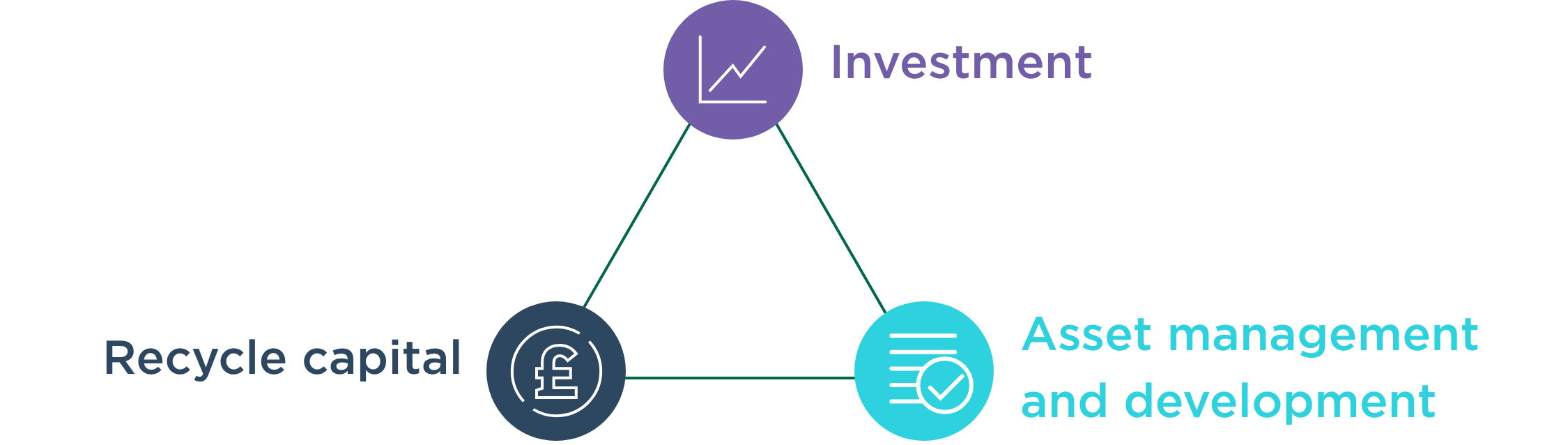

How we create value

Investment

We benefit from Tilstone’s extensive network to identify attractive opportunities for investment and development which can enable us to secure deals off-market, potentially on better terms.

Asset management and development

We actively manage our assets to drive rental growth and keep occupancy high. We invest in our properties to ensure they meet the needs of occupiers and we develop into markets with potential.

Recycle capital

We are long-term holders of our properties but regularly review our portfolio and look to crystallise value through asset disposals and recycle capital where future returns are lower than target or to pay down debt.

Creating economic value

Financial

We aim to deliver an average total accounting return of over 10% per annum for our shareholders. For our lenders, we are an attractive covenant with high-quality assets and a robust interest cover.

Occupiers

We provide high-quality, well-located space and our effective retention rate of 82.2% is a strong endorsement of our offer.

Environmental and social

Our asset management initiatives are improving the environmental credentials of our buildings. 60.2% of the portfolio is now EPC A to C rated and introducing green clauses to all new leases.